Forbes Media, LLC Investor's Business Daily, Inc. Each of the company logos represented herein are trademarks of Microsoft Corporation Dow Jones & Company Nasdaq, Inc. This page has not been authorized, sponsored, or otherwise approved or endorsed by the companies represented herein. Shares of the company have gained 26.8% in a year. The company pulled off a trailing four-quarter earnings surprise of 2.5%, on average.įlowserve has an estimated earnings growth rate of 64.5% for the current year.

#Zbra stock free#

Shares of the company have rallied 44.5% in a year.įlowserve ( FLS Quick Quote FLS - Free Report) currently carries a Zacks Rank #2 (Buy). Graco has an estimated earnings growth rate of 16.4% for the current year. The company delivered a trailing four-quarter earnings surprise of 7.9%, on average. Graco ( GGG Quick Quote GGG - Free Report) currently flaunts a Zacks Rank #1. Shares of the company have jumped 53.5% in a year. Ingersoll Rand has an estimated earnings growth rate of 14.8% for the current year.

You can see the complete list of today’s Zacks #1 Rank stocks here. The company delivered a trailing four-quarter earnings surprise of 12.6%, on average. Ingersoll Rand ( IR Quick Quote IR - Free Report) presently sports a Zacks Rank #1 (Strong Buy).

Some better-ranked stocks within the broader Industrial Products sector are as follows: Zebra Technologies presently carries a Zacks Rank #4 (Sell).

#Zbra stock software#

These have more memory, an advanced range of barcode scanning and the highest capacity field replaceable batteries.įeaturing Zebra Technologies’ Mobility DNA software suite, these tablets can easily be implemented, configured, managed and tailored for use in various industries and applications.

#Zbra stock series#

Zebra Technologies’ ET6x series of tablets operate on the Qualcomm QCS6490 processor with artificial intelligence and machine learning. Case in point: We've spotted 3 warning signs for Zebra Technologies you should be aware of, and 1 of them shouldn't be ignored.Zebra Technologies Corporation price | Zebra Technologies Corporation Quote But to truly gain insight, we need to consider other information, too. I find it very interesting to look at share price over the long term as a proxy for business performance. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. On the bright side, long term shareholders have made money, with a gain of 14% per year over half a decade. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Investors in Zebra Technologies had a tough year, with a total loss of 5.0%, against a market gain of about 14%.

It might be well worthwhile taking a look at our free report on Zebra Technologies' earnings, revenue and cash flow. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It's probably worth noting that the CEO is paid less than the median at similar sized companies. You can see below how EPS has changed over time (discover the exact values by clicking on the image). Therefore, it seems the market has become relatively pessimistic about the company. This EPS growth is higher than the 14% average annual increase in the share price. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).ĭuring five years of share price growth, Zebra Technologies achieved compound earnings per share (EPS) growth of 29% per year. In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.Ĭheck out our latest analysis for Zebra Technologies After all, the share price is up a market-beating 91% in that time.

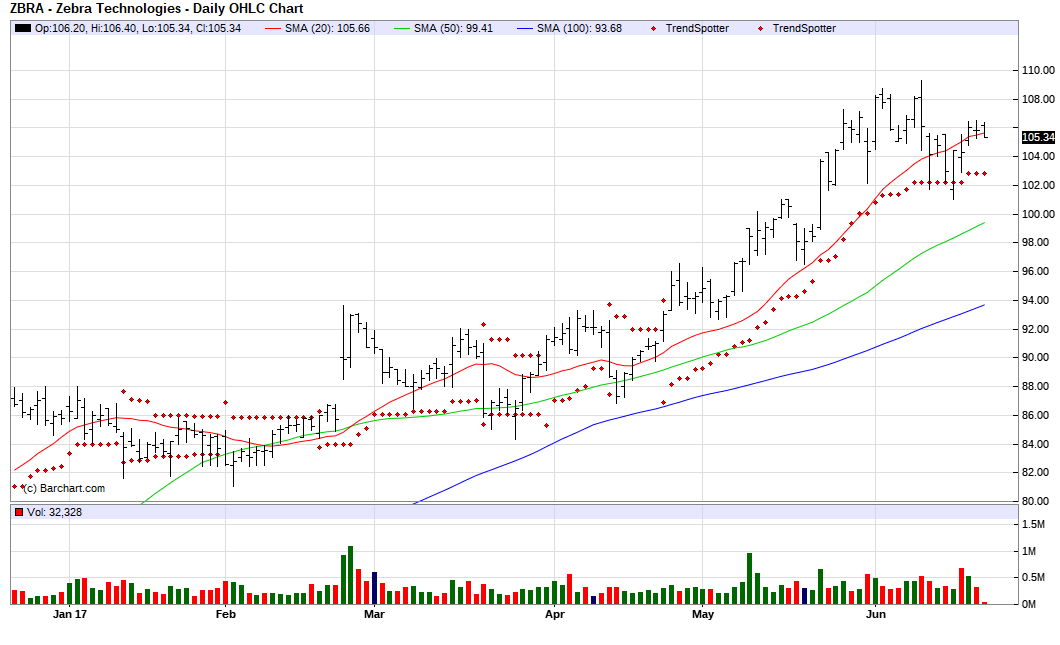

Looking further back, the stock has generated good profits over five years. While Zebra Technologies Corporation ( NASDAQ:ZBRA) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 11% in the last quarter.

0 kommentar(er)

0 kommentar(er)